If you are wondering why gold and silver have been selling off for the past few days while the news of shortage of the physicals is everywhere, here's the answer:

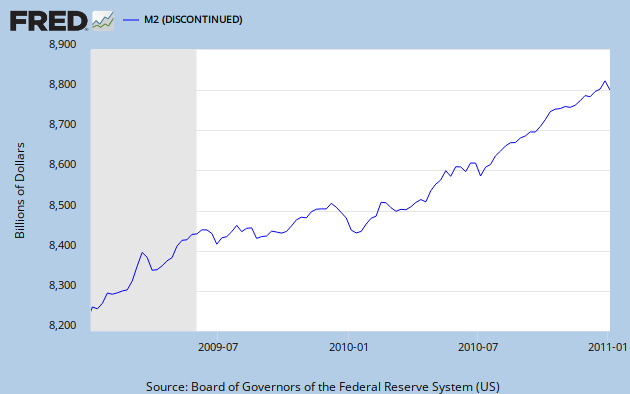

The COMEX hiked the margins on gold and silver again, along with a boatload of commodities that are rising thanks to Ben and the Inkjets printing digital money with abandon which is leaking mightily into M2. The new margins will become effective after the market close on Friday.

From Zero Hedge:

Wonder why the smart money was rushing headlong out of gold and silver over the past few days, and especially today in the AM session? Here is your answer: in tried and true fashion the Comex just hiked margins in gold, and silver by about 6%, and threw in a few other commodities to mask things up. And unlike the last time it did it, when it could at least pretend to justify its actions with the surge in gold price, this time with the PM complex dropping, we wonder what excuse the CME will use this time. Initial and Maintenance margins were just increased in everything from 10 Tr Oz Gold Futs, Comex 100 Gold Futures, Comex Miny Gold and Silver, E-mini Gold and Silver, Comex 5000 silver futures to Silver trade at settle. Also added were Copper, Iron Ore, propane, butane, and other nat gas. Most notably, and confirming that the administration and the money printing authorities are terrified by the surge in crude, the CME also hiked margins in various refined products and coal. The official scramble to "contain" the aftermath of Bernanke's lunacy is accelerating. We wonder when REDI, Prime Brokers and E-trade will comparable collapse purchasing margin for stock trading accounts. Of course, as with all other such superficial market interventions, the impact is shallow and is overrun in a matter of days.

And no...there was absolutely no leak this time. We promise.

Oh but gold and silver are "safe haven" commodities, and since the economy is recovering so fast and everything will be OK, or so our dear leaders are telling us, we don't need "safe haven" any more, do we?

Here's M2, from St. Louis Fed's FRED:

Consider it as buying opportunity, if you have fiat money to spare.

Tokyo Time

Tokyo Time

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

1 comments:

I think Gold is the best investment to make because it is more stable than any other option I have seen. It’s value has continued to increase over time, while the money you use to buy it only decreases in value. I use APMEX.com to buy precious metals. They have good prices on gold and silver and are very easy to use. They have always been reliable.

Post a Comment