Japan is sure unique. Probably the only "developed" nation left in the world whose financial markets go up on the word "Quantitative Easing", even with the kicker "unlimited". Even the US market has stopped responding positively to the word from the Fed officials.

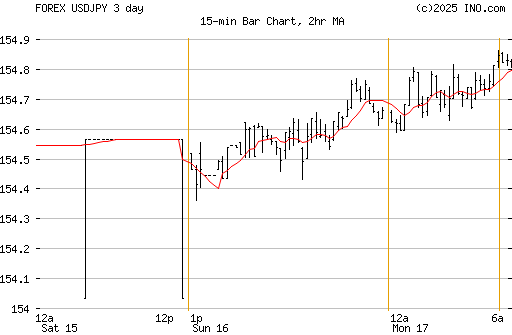

Yen dumps:

Nikkei up:

For now, uber-Keynesian Japanese celebrates the destruction of the financial markets that may come with QE 4Eva under the "curry and pork cutlet". Oh wait, in Japan's case, the financial markets been broken for 20 years anyway.

According to Nikkei Shinbun, Mr. Abe also mentioned "negative interest rate" to encourage lending. As if debt is capital and wealth.

Tokyo Time

Tokyo Time

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

12 comments:

Could it be that the Nikkei went up because the DPJ is about to go on the ash heap of history?

Oh, that's right. You think they're headed for a win.

Long time no see, "stupid idiot".

Hey, it's mister unnecessarily offensive!

Negative interest rate is good for big banks... bad for everyone else. Banks will not need anymore to make loans to make benefits and government's money will not be reaching those who need it.

The state would better directly loan itself (or give it away for what matters) to the citizenry, skipping the parasitic banks.

Not that I think that anything short of the biggest divine miracle ever (and I don't believe in that) can save Japan after Fukushima, sincerely. But regardless... giving money to banks instead than to the public directly is socio-economically suicidal.

I will, not would, buy a bag full of dollars, pounds, francs and sit wait till the yen hits 160.

If unlimited QE means unlimited purchase of bad assets then maybe it is reasonable Nikkei goes up and yen down. Would Abe purchase some of my Tepco stock at the price they had 2 yrs ago too?

Hopefully people will not vote back the LDP to squander taxpayer money this way, after all they money it already wasted on useless public works for 20 years.

Printing more money isn't going to work much longer Japan can only sustain a huge debt ratio as long as the Japanese own most of the debt. Unfortunately Japan's quickly shrinking and aging population is less like to buy bonds instead they will be looking to sell them to finance their retirement. In addition the retirees will start collecting retirement benefits putting further strain on the government purse strings.

IMF Says Japan And Spain Are Done, "Debt Ratio Will Never Stabilize"

http://www.zerohedge.com/news/imf-says-japan-and-spain-are-done-debt-ratio-will-never-stabilize

Japan's government debt is unsustainable, agrees economist Andy Xie, according to CNBC. Its interest expense is a quarter of its budget. "If the bond yield rises to 2 percent, the interest expense would surpass the total expected tax revenue (this year) of 42.3 trillion yen," Xie says.

http://www.moneynews.com/FinanceNews/Japan-Debt-Mother-Bubbles/2012/06/28/id/443771

So, what's got us so worried about the Japanese debt market? Well, for starters, Japan is quickly painting itself into a corner. Right now, every penny of government revenue goes to pay for debt service (interest payments on the debt) and pension benefits. Think about that: if Japan wants to pave a road, build a school, or buy toilet paper for the Imperial Palace, it's all going to be paid for with borrowed money, and that's how things look with long-term interest rates at 1%, so imagine how horrible the picture would look if interest rates, and thus debt service costs, were substantially higher?

The pool of Japanese bond buyers is drying up quickly, as well. Already, the share of Japanese debt that has to be funded outside its own borders has doubled, with fully 20% of its short-term debt now being financed by outsiders. And starting this year, the first wave of Japan's Baby Boomers turn 65, making them eligible to start collecting their pension, which means that instead of accumulating wealth and buying bonds to save for retirement, a greater and greater portion of the population will now become net sellers of bonds to finance their retirement needs. And at the same time, as the number of people in retirement continues to mount, the government will experience a squeeze on both ends: income tax revenue will decrease, while the amount paid out in retirement benefits increases.

http://seekingalpha.com/article/384141-land-of-the-rising-debt-to-gdp-ratio

@7:22 given the dire picture you describe, why are Japan interest rates still so low? Is the market not factoring in any risk?

A broken clock is right twice a day. If only Zero Hedge were as accurate...

@12:19

Didn't you bother to read any of the articles beyond what was posted? Up until recently the Japanese have held a majority of the bond debt they have generated this has allowed an unnaturally low interest rate. But that is beginning to change as Japan ages more and more people are selling off their bonds and looking to collect retirement benefits.

As for zerohedge they aren't the only people saying it (that's why I posted more than one source) even Japan's own Government Pension Investment Fund admitted this year that that pension payouts already exceed revenue and the baby boomers are just starting to retire.

"Cracks are already appearing, however. A surge in energy imports to compensate for nuclear plants idled after last year’s quake gave Japan a record current account deficit in January. JPMorgan expects the shortfall to become chronic by 2015. Barclays (BCS) thinks the switch will happen in 2018. The Government Pension Investment Fund oversees 113.6 trillion yen ($1.45 trillion) and is historically one of the biggest buyers of Japanese debt, currently about 63 percent of its assets. Late in July it revealed that pension payouts already exceed revenue as baby boomers turn 65 and qualify for payments. “We need to sell Japanese government bonds to raise cash,” says the fund’s president, Takahiro Mitani. If too many institutions have to sell bonds, yields will rise."

http://www.businessweek.com/articles/2012-08-09/a-tax-revolt-in-japan-and-a-bond-bubble-too

Actually, I'm looking forward to a LDP win of sorts. It is only fair that the architects of Japan's last 60 odd years take responsibility for their chronic 'policies' and failures.

Pork cutlet in charge is just about right IMHO. And with 'unlimited' yen printing, hyperinflation will be brought forward. Bring on the tonkatsu sauce.

" And with 'unlimited' yen printing, hyperinflation will be brought forward. Bring on the tonkatsu sauce. "

Try and bring up the subject with your family and friends, they'll love it.

Post a Comment